The latest figures on R&D claims were published by The Office for National Statistics (ONS) today. They cover 2017-2018 and due to the backwards looking nature of R&D claims, companies can claim within two years of an accounting period end for that period, will understate the numbers.

Headlines 2017-2018.

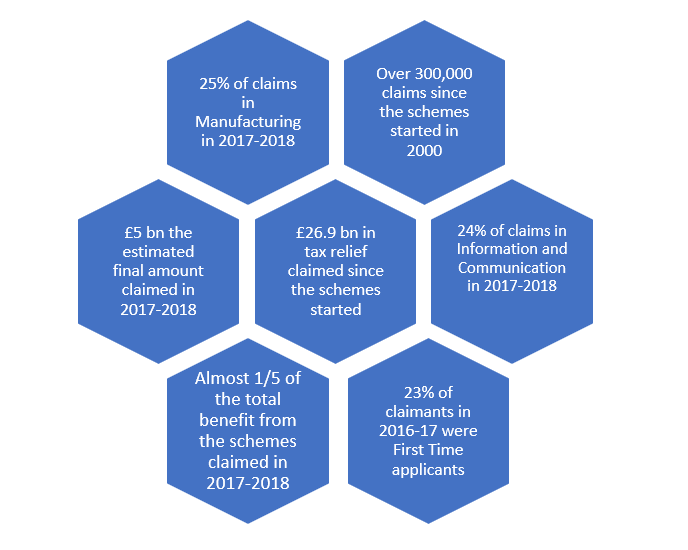

- £4.3 billion of tax relief support estimated to rise to £5 billion. (Final Revised figure for 2016-2017 £4.4 Billion)

- 42,705 SME R&D claims. (Final Revised figure for 2016-2017 45,045)

- For the largely finalist 2016-17 23% of claimants were first time.

- Over 300,000 claims since the two scheme began.

- £26.9 Billion in relief since the two scheme began.

- Final figures for 2017-18 expected to reach almost £5 billion. This means almost 1/5 of the amount claimed in 18 years will be in that one year.

- 2016-17 figures are much more finalised than 2017-2018 they showed 23% of claimants were first time.

- 25% of claims were “Manufacturing”, 24% “Information and Communication,” and 20% “Professional, Scientific, and Technical”.

- The other 31%? “Wholesale & Retail Trade, Repairs”, “Financial & Insurance”, “Admin & Support Services”, “Mining & quarrying”, “Arts, Entertainment, and Recreation” are the larger components.

- Software development likely to be under represented in “Information & Communication” because Software is likely to be in a lot of areas, as they rank on the companies area of activity not the nature of the R&D Claim.

So, what is the trend?

A straight reading suggests a fall in claims and support. Claims for years ending between October 2017 and March 2018 are still being made. We are making them this month and will continue to make claims for years ending in that period until 31st March 2020. So, the important numbers for comparison are the original 2016-2017 numbers.

2016-2017 Published in September 2018

£3.5 billion in tax relief support

34,060 SME R&D Claims

Conclusion

SME Claims up 25%

So, like for like at the same point in the reporting cycle the amount of support is up by almost 23% and the number of claims is up 25%. Remember we are looking back, but as of 2017-2018 it is hard to see any fall back in R&D claim activity, just huge growth.

To estimate forward. It is likely by this time next year we could see a more complete level of support at £5.4 billion with something like 56,000 SME R&D claims for 2017-18 extrapolating this from the previous rise in 2016-2017 the numbers.

This is great news for the government who have put R&D at the forefront of post Brexit economic policy & SMEs drive the UK economy.

Our experience suggests that many companies are still missing out on this vital funding by not claiming or underclaiming. Our website offers great guidance on potential qualification but for a clear answer get in touch with us today for a free assessment and talk to one of our specialists.

References

1 thought on “New National Statistics are out. Has the approach of Brexit hit UK SME R&D claims?”

Hereare the latest Stats from HMRC and a post from our Compliance Director.

PM me for more information or click on https://www.randdtax.co.uk/our-team/jaime-lumsden/