In April 2020 the UK Government released Research and Development Tax Credits Supplementary breakdowns: April 2020. These followed the statistical report and detailed tables released in October 2019.

I have taken a look at both sets of data and created some charts and tables to illustrate trends, including the rise in claim levels and which Regions and Sectors are getting the benefits.

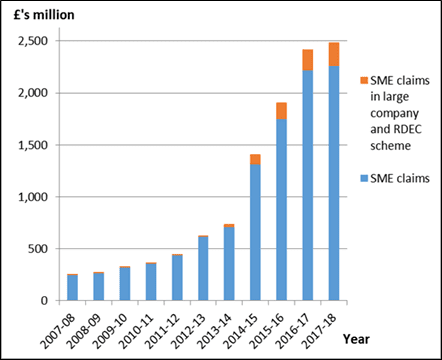

It needs to be kept in mind that there is a data lag due to companies being able to claim going back two years. The data released in October 2019 was based on claims for R&D tax credits made in Company Tax returns received on or before 30 June 2019 and therefore the 2017-18 figures represent partial data and are expected to increase as more returns are received by HMRC.

The following table shows that at the last count in 2017-18 around £2.5 billion went to UK Small & Medium Enterprises, compared to just £250 million ten years earlier. It is expected that the 2017-18 level will reach around £3 billion when all claims have been completed.

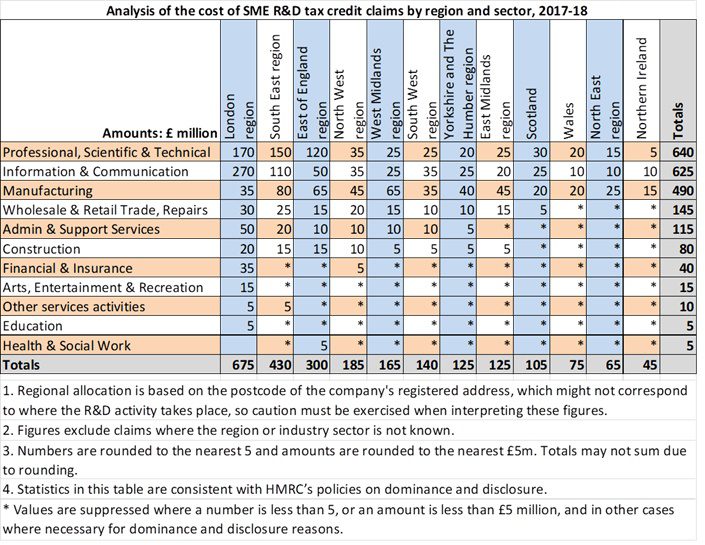

Data released in April 2020 gave an indication of the amount of funding per Sector and Region. The table belows shows that the London Region claimed the most funding at £675 million followed by the South East Region at £430 million (based on post codes – see the notes below the chart).

The sector in London that received most funding was Information & Communication – which will include the Fintech and Software development companies based in London.

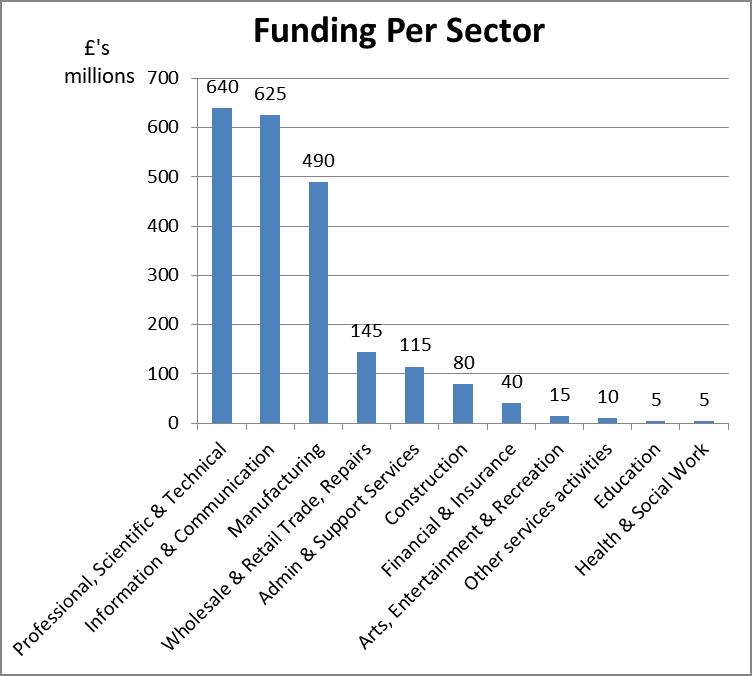

Overall, across all regions the Professional, Scientific & Technical sector represented the largest share of funding at £640 million followed by the Professional, Scientific & Technical sector at £625 million and Maufacturing at £490 million.

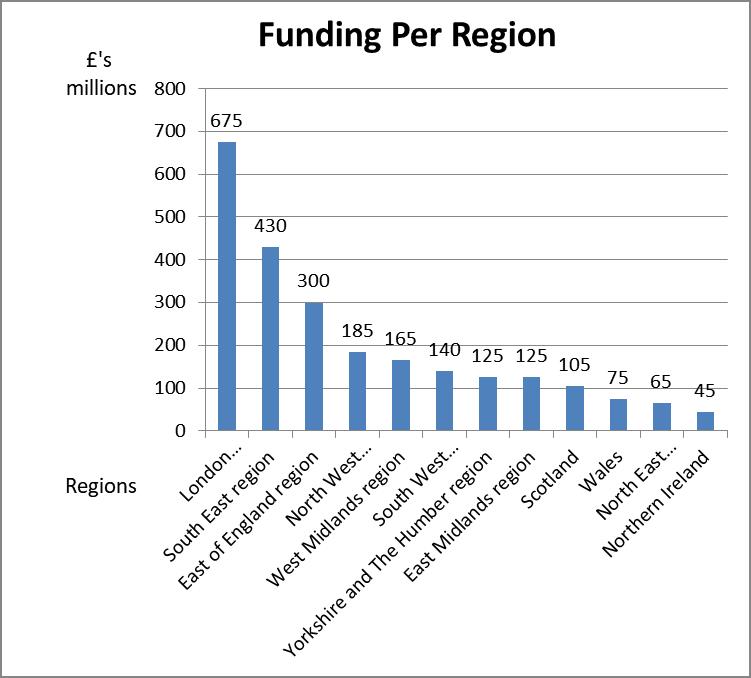

Funding per Region (SMEs)

The graph below shows the funding per region in order of scale with the largest first, again based on post codes (see note under the table above). The top three regions, London, the South East and the East of England, between them shared £1,405 million which equates to just under 58% of all the funding going to SMEs, while the bottom three, Wales the North East and Northern Ireland shared between them £185 million, just under 8% of the total funding going to SMEs.

Funding per Sector (SMEs) The graph below shows the funding per sector in order of scale with the largest first. There are other sectors that are not listed as no significant funding went to them. The top three sectors, Professional, Scientific & Technical, Information & Communication and Manufacturing between them shared £1,755 million which equates to around 80% of the total funding going to SMEs.

Link to HMRC source: https://www.gov.uk/government/statistics/corporate-tax-research-and-development-tax-credit

RandDTax have helped over 1250 companies gain almost £140 million in benefit from the R&D Tax Credit schemes. If you would like to discuss a claim please get in touch.