The statistics always require a careful reading as claims for the most recent years covered will not be complete due to the nature of the scheme. Companies can claim within two years of the end of the accounting period in which the expenditure is incurred.

Because of this while figures are available for 2018-2019 they are incomplete and 2017-2018 are now complete.

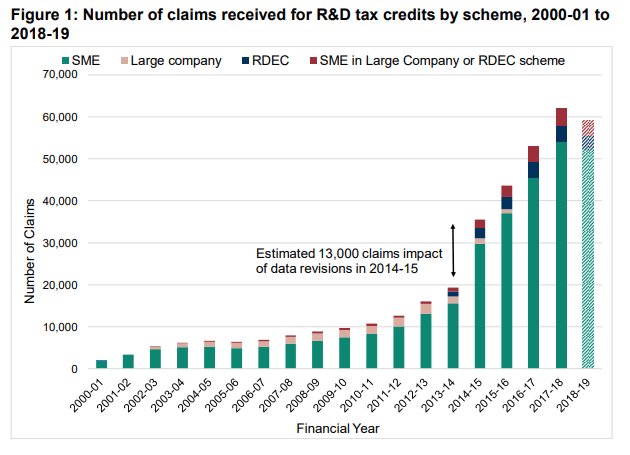

In 2017-2018 the total number of claims were 62,095. This represented a 17% increase from 2016-2017. This was driven by SME (Small and medium enterprises) claims which totalled 54,005 a 19% rise.

Covid 19

Covid does not impact these claim years as they all end before March 2020. Next years stats will cover the period 2019-2020 Covid is unlikely to impact these claims as they only cover a few weeks of Covid lockdown in the UK. So we won't see statistics on the impact of Covid until the 2020-2021 statistics are published in September 2022.

I do feel these lagging indicators are a problem in terms of the Government having the information to fully understand the impact of Covid on companies doing R&D. Qualifying expenditure will certainly fall with R&D staff put on furlough. Inactive staff cannot be doing R&D. The key test is moving from the crisis period back to activity for all industry sectors. Innovative companies are particularly important in this respect and for economic growth. The Government needs data to make these decisions. These statistics are not helpful in that respect.

Suggestion

I do think it might be useful in the absence of data for the Government to survey the R&D consultancy industry to understand the challenges our clients' face. This could be done through the HMRC R&D committee (RDCC). It would be an effective way to get some live information. If R&D Expenditure is currently dropping? From a growth and a V shaped recovery perspective the Government should do all it can to fire it up again.

Conclusion

“Between 2000-01, when the R&D tax credit schemes were launched, and

2018-19, over 300,000 claims have been made and £33.3bn in tax relief

claimed.” September 2020 report.

It is a great scheme. The benefit to the UK through the R&D Tax Credit investment in R&D is huge due through the multiplier effect of that expenditure. R&D activity creates a skilled and well paid work force. The UK Information Technology sector for example is the most significant of any European country. Our engineering and manufacturing sectors are stronger than many think and benefit from being innovation specialists. Our Universities are great drivers for innovation in sectors like artificial intelligence and biotechnology but the UK only gets the benefit through linking their research to industry. The backward looking statistics released today look great, but tell us little about the present or future. This is where policy makers need to look to now.

Christopher Toms MA MAAT – Director RandDTax.