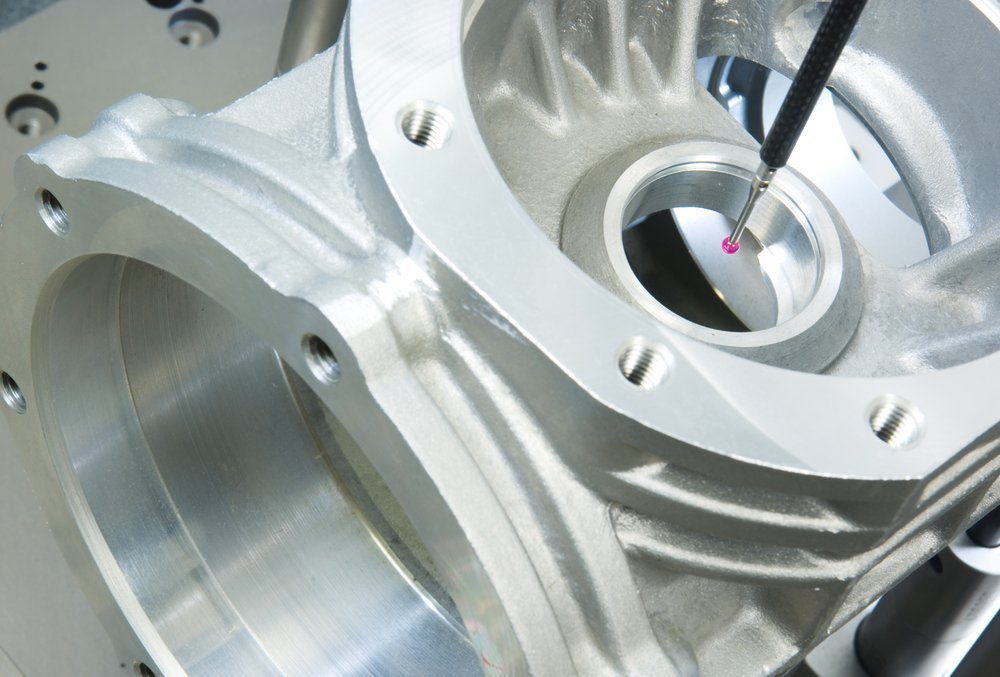

Does your company design, machine and fabricate prototypes or technically advanced components….or do you develop and manufacture sub-assemblies for your customers.

The easiest way to ascertain whether you can claim Research and Development Tax Credits is to ask yourself………

Many Precision Engineers are claiming R&D Tax Credits – shouldn’t you?

- Do I design, machine or fabricate innovative components and sub-assemblies?

- Do I have to overcome technical uncertainties when working out how best to machine or assemble the products?

- Is there prototype manufacture trialing and testing involved, until it can be satisfactorily machined or assembled?

- Do I take the risk in designing the prototypes? I only get paid if my solution is successful.

- If this sounds familiar, then it’s very likely that you are eligible to make a R&D Tax claim.

How do you claim and what does it cost?

The first step is to speak to an R&D Tax Credit specialist. This really should cost you nothing. It’s just an exploratory question and answer session, usually on the phone, and then you’ll know whether you should be claiming.

The second step is to set up a scoping meeting, see what you should be claiming for and how much. Again, this should cost you absolutely nothing. You’re just seeking information before you decide to claim.

The third step is to claim. You need a Technical Justification for HMRC and a list of qualifying costs. Your R&D Tax Specialist will help you to complete the Technical Justification and will advise you on what qualifying expenditure to include in your claim. This should not cost you more than 18% of the actual credit successfully claimed. (Be careful, some R&D Tax firms charge 20% or more and like to impose their own Tax Accountant on you, often with additional charges.)

The fourth step is to instruct your own Accountant to submit the claim.

- The good news is that it usually only takes 28 days for the cheque to arrive and …..your claim can go back two years to retrospectively recover R&D Tax credits. (The average claim is £43K for SMEs, according to HMRC)

Jaime Lumsden, Director