The latest official figures on R&D tax relief were released by HMRC on 30 September 2025, covering claims for the 2023–24 tax year. These statistics provide a clear view of how the incentive is being reshaped by recent reforms, compliance measures, and shifting patterns of innovation investment.

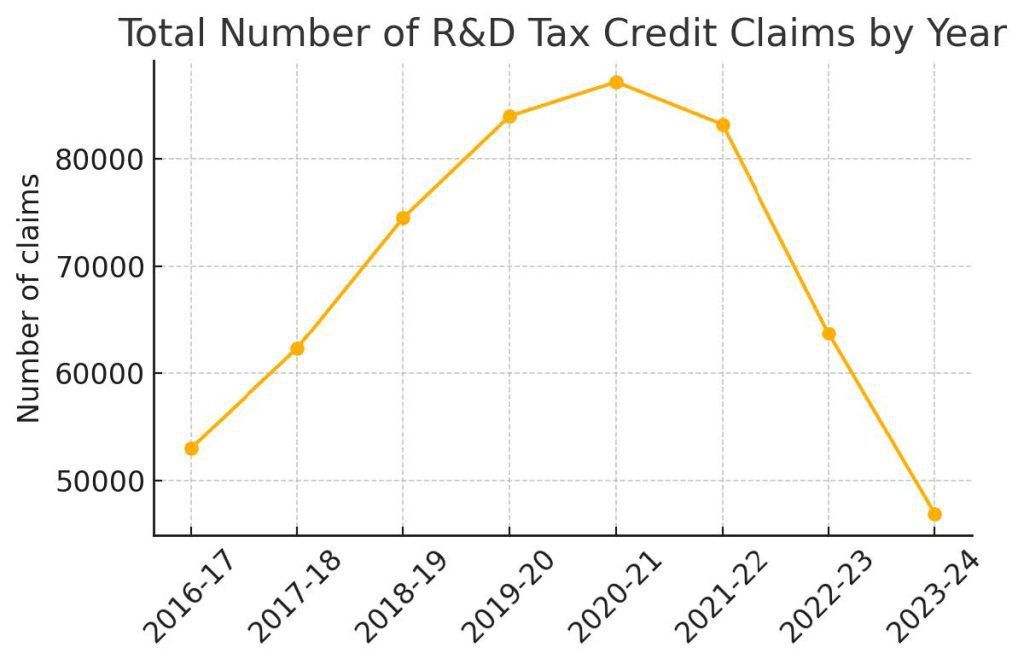

Figure 1: Total number of R&D tax credit claims by year (2016–17 to 2023–24). After peaking in 2020–21, the

number of claims has collapsed over the last two years, reaching ~46.9k in 2023–24 (nearly half the count

from 2020–21). The decline has been most pronounced for SME claims, due to reduced generosity and stricter

compliance.

The headline number is that total R&D tax relief claimed was £7.6 billion, a modest fall of 2 percent compared with the prior year. Underneath this headline, however, the picture looks very different for small and large businesses.

The number of claims fell sharply again, down 26 percent to 46,950. This marks the lowest level of claims in almost a decade, with volumes less than half what they were only two years ago. SMEs have borne the brunt of this reduction. SME claims fell 31 percent year on year, while RDEC claims fell by only 5 percent. Over three years, the SME scheme has seen a 52 percent collapse in claim numbers.

This decline is not only numerical but also financial. The value of SME relief fell by 29 percent to £3.15 billion, while RDEC relief grew by 36 percent to £4.41 billion. For the first time, large companies claiming under RDEC received the majority share of the overall support pot. The balance of the scheme has moved decisively towards bigger businesses.

Why is this happening? The causes are clear. From April 2023 the SME scheme became less generous, with the additional deduction cut from 130 percent to 86 percent and the payable credit rate reduced from 14.5 percent to 10 percent. At the same time, the RDEC rate was increased from 13 percent to 20 percent, making it more valuable for large companies. Compliance has also been stepped up, with the mandatory Additional Information Form and a sharp increase in HMRC enquiries. In 2023–24, 17 percent of all claims were enquired into, with most requiring amendment.

The result has been a squeeze on small and early-stage claims. The steepest falls have been among claims worth under £15,000, while claims over £250,000 and especially those over £1 million have grown. Average claim size rose by a third in one year.

The regional and sector breakdowns show familiar trends. London-based companies accounted for almost a third of relief, and high-tech industries such as information technology, manufacturing, and professional and scientific services together represented over 70 percent of claims. In contrast, claims from sectors previously linked with ineligible submissions, such as accommodation, food, and real estate, dropped dramatically.

Perhaps the most concerning signal is the collapse in first-time claimants. Only 0.42 percent of new companies claimed R&D relief in 2023–24, the lowest proportion ever recorded. This suggests fewer start-ups are engaging with the scheme, raising doubts about whether the incentive is still achieving its goal of stimulating innovation among emerging businesses.

From April 2024, the separate SME and RDEC schemes will be replaced by a single merged scheme, with a special uplift for R&D-intensive SMEs. Whether this new system restores balance remains to be seen. For now, the statistics show a scheme that is cleaner and more compliant, but also smaller and increasingly tilted towards large companies.

For SMEs still undertaking genuine innovation, the message is that opportunities remain, but they must be approached with care. Claims need to be robust, well-evidenced, and supported by professional expertise. With HMRC scrutiny now at its highest level, preparation and compliance are critical.

If your company is considering a claim or needs guidance on navigating these changes, our team can help ensure that your R&D work is properly recognised and rewarded.

Contact us today to discuss how these changes affect your business.

Christopher Toms MA MAAT

Compliance Director

RandDTax