Introduction

With the introduction of the UK’s new merged R&D tax relief regime for accounting periods beginning on or after 1 April 2024, most companies now fall under a unified scheme aligned with the RDEC model. While this consolidation simplifies the framework in some respects, the government has retained Enhanced R&D Intensive Support (ERIS) for loss-making SMEs whose qualifying R&D expenditure is at least 30% of total expenditure.

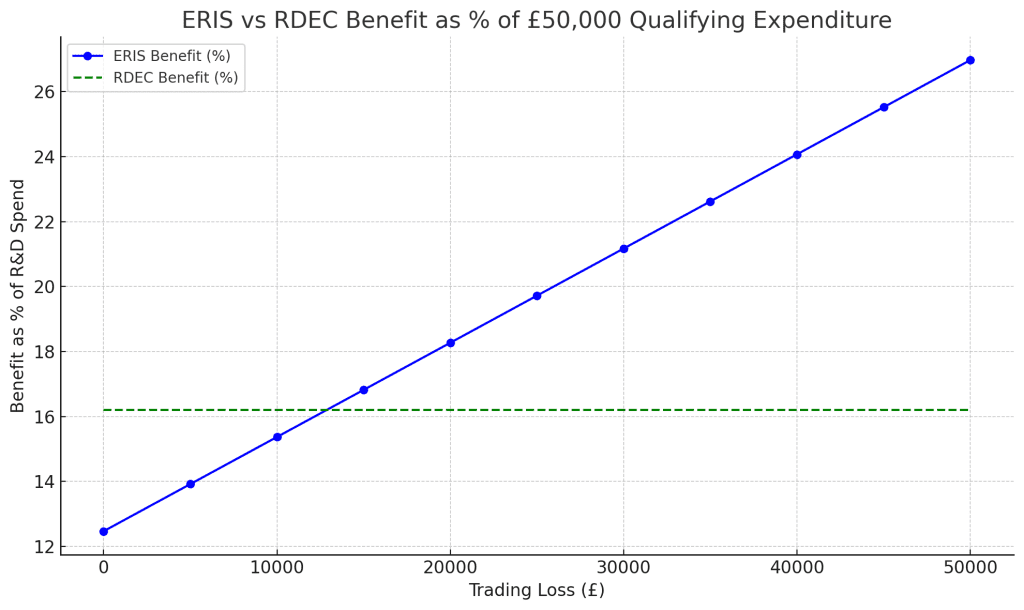

At first glance, ERIS may appear to offer the most generous benefit for qualifying companies, particularly given its 14.5% payable credit on surrenderable losses. However, when trading losses are marginal, the ERIS scheme may provide a lower effective return than a standard RDEC claim.

Why the Tipping Point Matters

ERIS applies a 14.5% credit to the surrenderable loss, which is the lower of:

- The enhanced R&D expenditure: qualifying R&D plus the 86% uplift; and

- The enhanced trading loss: the accounting loss plus the 86% uplift.

When a company is only modestly loss-making, it is the second cap, the enhanced trading loss, that constrains the surrenderable amount. This can significantly reduce the cash benefit of ERIS, to the point where the post-tax benefit under the standard RDEC model is higher.

Worked Example

Assume a company incurs:

- £50,000 in qualifying R&D expenditure; and

- a trading loss of just £10.

Under ERIS:

- Additional deduction: £43,000 (86% of £50,000)

- Enhanced loss: £43,010

- Enhanced expenditure: £93,000

- Surrenderable loss = £43,010 (lower of the two)

- Tax credit at 14.5% = £6,236

- Effective benefit = 12.47% of qualifying R&D spend

Under RDEC:

- RDEC rate = 20% of £50,000 = £10,000

- Net benefit after 19% notional tax = £8,100

- Effective benefit = 16.2% of qualifying R&D spend

This example illustrates how a company with minimal losses, despite qualifying as R&D-intensive, can derive greater benefit through a conventional RDEC claim.

Where Is the Breakeven Point?

Our modelling indicates the breakeven point arises when a company’s trading loss equals approximately 25.7% of its qualifying R&D expenditure. Below this threshold, ERIS produces a lower return than RDEC.

- For £50,000 of R&D costs, a trading loss below £12,862 results in RDEC providing a superior cash benefit.

Practical Implications

R&D-intensive SMEs should not automatically default to ERIS. The higher notional rate under ERIS only results in a greater return if the trading loss is large enough not always.

The merged regime has thus introduced a new and critical optimisation question: where ERIS eligibility exists, is the trading loss sufficient to justify ERIS?

Recommendations for Claimants and Advisors

- Model both ERIS and RDEC scenarios where ERIS eligibility is met.

- Calculate the effective return under both options.

- Use 25.7% of R&D spend as an approximate loss threshold — if trading losses fall below this, RDEC should be more beneficial.

- Consider the impact of timing and other reliefs — a company’s tax position, group structure, or expected future profits may also influence the decision.

Conclusion

ERIS is a valuable mechanism for high-intensity R&D companies, but it is not universally optimal. A marginal trading loss may result in a restricted claim under ERIS, making RDEC the more favourable option. Understanding this tipping point, and modelling both routes, is now essential for accurate and strategic R&D tax planning.

From a legislative perspective, it is disappointing that this flaw exists. The ERIS scheme was intended to provide a superior rate of relief for R&D-intensive, loss-making SMEs, yet in practice, it often fails to do so. One of the principal justifications for the merged RDEC scheme was to offer a more stable and predictable benefit, unaffected by a company’s tax position — unlike the previous SME tax credit. Unfortunately, ERIS undermines both aims: it delivers a less generous outcome than standard RDEC in some scenarios and introduces volatility directly tied to the tax position. A more coherent solution would have been to offer a higher RDEC rate, for example, 30%, to R&D-intensive SMEs, preserving the simplicity and consistency of the merged regime while still recognising their higher investment levels. With more careful design, this legislative gap could and should have been avoided.

If you are unsure which route provides the optimal benefit under the new regime, or need tailored modelling for your specific tax position, we can help.

Christopher Toms MA MAAT

Compliance Director

RandDTax