R&D Tax Credits

Glasgow

Notably famous for its ship and boat building industry as well as being a global competitor in higher education and the financial services sectors, Glasgow continues to push the boundaries of research and development. Whether you’re leading the way with a new innovative service or modifying an existing product, RandDTax can help identify which benefits are available to you and your business. Many businesses don’t know they qualify for R&D credit claims, so uncover the hidden value in your business with help from RandDTax today!

We believe in supporting UK economic growth at RandDTax . We’re fair on fees that operate on a no-win, no-fee basis and we also offer free R&D consultancy for start-ups. In fact, for every 10 new clients we sign up, to do the first years trading R&D claim for free for one start-up!

Get in touch with our R&D tax consultants based in Glasgow today. Our experienced tax consultants have wide experience and knowledge in R&D tax claims. Get started with our FREE ASSESSMENT or to find out more about how you can claim R&D tax credits and how much you can claim, contact us today.

Find out more

The short answer is to contact us!

These 3 questions to help guide you on whether your project qualifies for R&D tax credits;

- Does your company develop new products, processes, services or materials, or develop science and technology to enhance existing ones?

- Does your company set out to achieve an advance in scientific or technological knowledge or capability?

- Does your project involve and technical or scientific uncertainty that a professional in your field cannot readily resolve?

If your project can answer yes to all these questions then it’s worth investigating further if you have an R&D claim.

Each ‘cost’ has specific rules around the correct treatment. However, some notable costs you can claim R&D credits include; staff costs, software, consumables and sub-contractors.

Yes! Explore our claims calculator to discover how much an R&D claim might be worth for your company.

R&D Tax Relief is available to UK limited companies, using science or technology as part of an innovative process/product.

Generally, no. R&D expenditure relates to revenue expenditure. It is possible under the intangible assets regime to capitalise revenue expenditure. This expense can be claimed if it is deducted back in the tax computation or when it is amortised.

Yes, it is worth it! On average our clients have claimed over £103k each. Our consultants do everything they can do to make the claim process as easy as possible.

Get in touch with our regional consultants for a free assessment.

Our expert advisors have wide experience and knowledge in R&D tax claims. Get started today with our Free Assessment or find out more about how you can claim R&D tax credits, if your company is eligible, how much you can claim and much more.

Your Regional Consultants

Loading...

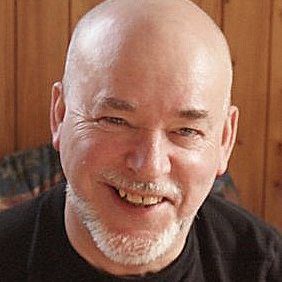

Chris Toms

Jaime Lumsden

Christopher Lumsden

Contact us today!

Our expert consultants are ready to help.