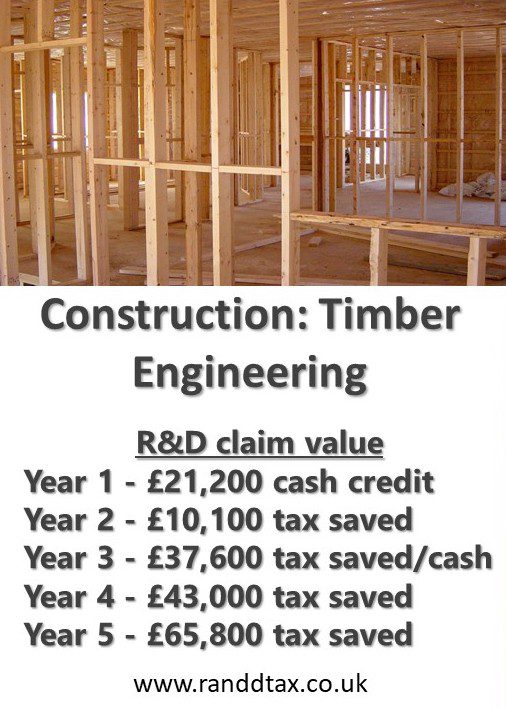

Wood engineering pioneers illustrate one example of the relevance of Research and Development (R&D) Tax Relief and Tax Credit to the Construction Industry – claiming tax reductions and cash credits worth over £177,000 over a five year period.

The company has developed a raft of solutions including the use of timber to separate rooms instead of the more traditional masonry walls. It also developed timber solutions to replace steel by engineering wood for higher load bearing capacity.

Anecdotal evidence seems to imply that the Construction Industry is lagging behind in recognising where there is scope to claim R&D incentives, despite there often being R&D involved in the development of engineering solutions.

A specialist in innovative wood engineering for the construction industry including:-

- Use of innovative wood engineering to develop panelised roofing design.

- Development of timber separating walls to replace masonry blockwork.

- Timber solutions to reduce costs – e.g. partial offsite fabrication.

- Timber engineering for higher load capability, less need for steelwork.

- Design to overcome fire, sound and wind/snow loading uncertainties.

Many construction businesses do work that is eligible for R & D tax credits without realising they could claim. See how much you could claim by using our R & D tax credit calculator.