In return, we can save your time by preparing robust R&D claims to get you government money back for the hard work you do for all of us, without stress, hassle and eye-watering fees.

Despite MedTech being one of the largest, growing industries in the UK, there are still misconceptions around who can claim and what qualifies as “research and development”.

At the most basic level, for R&D tax purposes, development needs to satisfy two main criteria:

- achieving an advance in science or technology

- overcoming a scientific or technological uncertainty

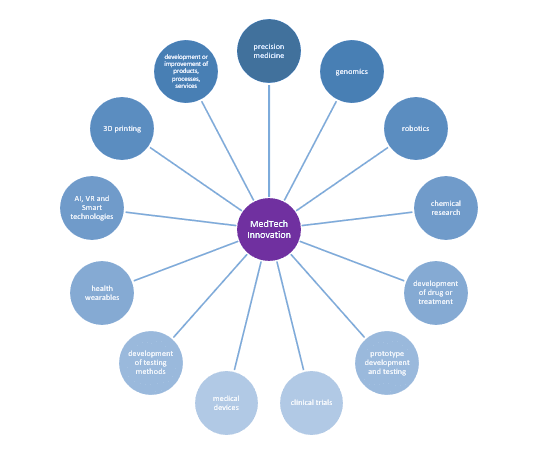

However, many businesses might think that what they are doing is not particularly innovative or scientifically advanced. The good news is that medical innovation doesn’t end in labs or equipment manufacturers, R&D is in the very fabric of the industry, whether it is next generation technologies, enhanced medical devices and products, or health wearables, 3D printing, AI, VR and smart technologies, – all that helps to save lives and improve health care.

Even projects that may be considered simple may still qualify, if there was a need to overcome technological uncertainty with insufficient or no information available on how to create or improve products or processes.

What qualifies for MedTech research and development?

All of the above are examples of medical activities which qualify for an R&D claim. More good news is that you can still claim if your company is making a loss, your projects were unsuccessful, or you received a government grant.

Innovator’s insight

One of our clients, who has experienced the benefits of R&D tax credits, is Aceso Global Health Consultants. We have worked with Aceso since 2018 and have seen how the scheme has enabled them to continue developing a broad spectrum of solutions spanning immunotherapy, anti-microbial resistance, community consanguinity, epidemiological research, maternal health services and a One Health approach.

Dr Logan Manikam, Director says:

“At Aceso, we are constantly developing innovative solutions to improve public health through collaborative research and innovation. Recently, the credits have been used to set up our flagship project in India, Indonesia & Chile. Called the Childhood Infections & Pollution (CHIP) Consortium (https://www.acesoghc.com/chip) , it aims to reduce the infection and anti-microbial resistance burden in under-5 children in slums using technology enabled citizen science approaches. We’ll continue to invest our tax credits in subsequent years to expand CHIP’s Consortium’s activities to Turkey, Thailand, Nigeria & Sierra Leone.

Crucially, even if you’ve made your claim already, there is still something special we can do for you. With our Free Audit, we can assess you previous claims with a good chance we can maximise it by identifying all of your eligible activity, producing robust technical evidence and giving you peace of mind that it’s being done well.

Tim Walsh CTA MBA – Director RandDTax.